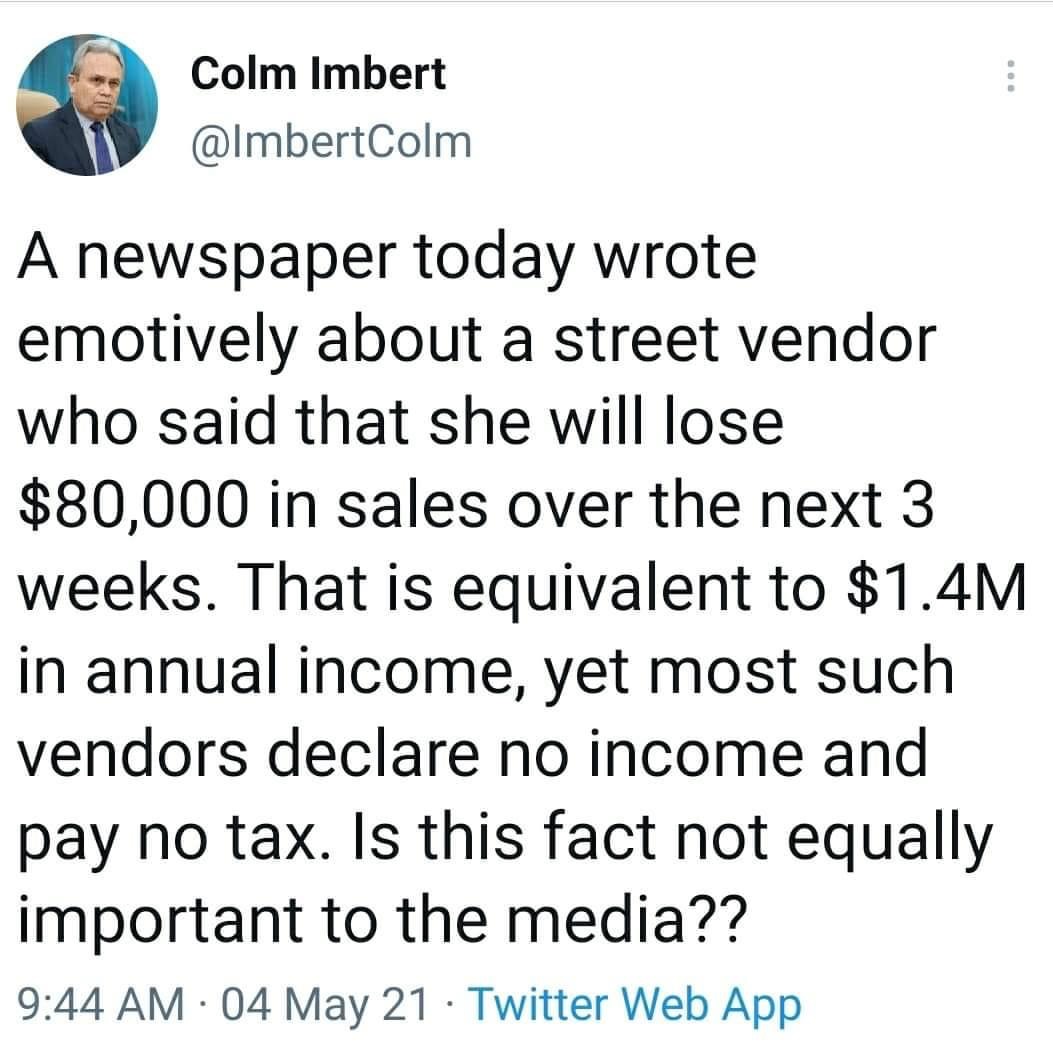

So, this showed up on our feed today.

This serves as a timely reminder that businesses (Sole traders, Partnerships, Limited Liability Companies) have a legal and moral obligation to file and pay their taxes. Though most businesses don’t like hearing it, and many are still unaware of their obligation, one still ought to file one’s tax returns even though there’s been no income or profits generated in the business over the last year.

Tax Returns are due to be filed by April 30. This will cover your tax obligations for the previous calendar year.

Sole Traders – Income Tax Return

Partnership – Partnership Tax Return

Limited Liability Companies – Corporation Tax Return

Failure to file will incur penalties of $100 for Sole Traders, Self-Employed persons, or Partnerships, for every 6 months that their Tax Returns remain outstanding, and $1000 for Limited Liability Companies for every 6 months that their Tax Returns remain outstanding.

Therefore, you have up to 6 months after April 30 to file your return for the previous year, penalty-free.

This applies to all persons who own a business or are self-employed.

Please note that:

- Filing your Tax Return is mandatory. It must be done every year – the only excluded groups would be individuals who only earn what is called emolument income – money earned solely as an employee of a business/organization, or only receive income via pension.

- Paying or remitting your taxes and Filing your Tax Returns are two separate/different activities.

If there are outstanding payments of Corporation/Income tax, they must be paid by April 30. This is the final date for those outstanding income tax payments for the previous year to be made without accruing interest. An interest charge of 20% per annum comes into effect from the day after this date to the date the income tax is paid.

Businesses should aim to pay their taxes on time as it provides revenue to the government to pay the salaries of government employees, support and maintain the nation’s common resources like the protective services and other essential services. Paying our taxes also helps us contribute to the provision of proper infrastructure.

We understand too, that tax filing can be a burdensome undertaking, especially for small businesses. There are several growing businesses that assist in this area. You can also seek the help of an accountant. The government has also instituted an online E-tax platform to facilitate easier filing and payment. It is also extremely important that one understands their tax liability as it relates to their business structure, i.e., sole proprietor, partnership, companies.

If you would like to chat more about your business structure and your taxes, join us for a Discovery call at your convenience:

https://calendly.com/thetimelyentrepreneur/discovery-sessions?month=2021-05